Fintech Layered Compliance

Navigating the Maze of Fintech Compliance: PCI, GDPR, PSD2, & DORA Unleashed! 🚀

Introduction: Hey, fintech enthusiasts! 🌟 Ready to dive into the alphabet soup of compliance that keeps our digital finance world safe and sound? Buckle up! We’re zooming through the landscape of PCI DSS, GDPR, PSD2, and DORA—each a powerhouse ensuring that every transaction you make is secure, private, and resilient against cyber threats. Let’s break down these big players and discover how they layer up to protect us! 🛡️

1. PCI DSS: The First Line of Defense for Payment Security

- What’s the Buzz? PCI DSS stands for Payment Card Industry Data Security Standard. Think of it as the superhero guarding card data. Whether you’re swiping, tapping, or clicking, PCI DSS is there to ensure that your card details stay in a digital vault, safe from prying eyes. 🔒

- Key Highlights: It mandates encryption, access control, vulnerability management, and regular security testing among other requirements.

2. GDPR: Your Privacy Shield

- What’s the Scoop? The General Data Protection Regulation (GDPR) is like the privacy police of the EU (but in a good way!). It gives control back to individuals over their personal data while slapping hefty fines on those who don’t play by the rules. 🚓

- Why It Rocks: It’s all about consent, rights to access, and the right to be forgotten. GDPR makes sure that companies respect your privacy and are clear about what they do with your data.

3. PSD2: Revolutionizing Payment Services

- The Lowdown: The Payment Services Directive 2 (PSD2) is shaking up the European payment industry by enhancing consumer protection, promoting innovation, and improving the security of payment services. 💥

- Cool Features: It introduces strict security requirements for electronic payments and the protection of financial data, radically changing the way the EU payment market operates.

4. DORA: The Digital Fortress

- Why It Matters: The Digital Operational Resilience Act (DORA) is set to be the new kid on the block, focusing on the digital operational resilience of the financial sector in the EU. Think of it as the digital immune system for the financial industry. 🛡️

- Impact Points: It covers everything from risk management to incident reporting and testing the resilience of digital systems.

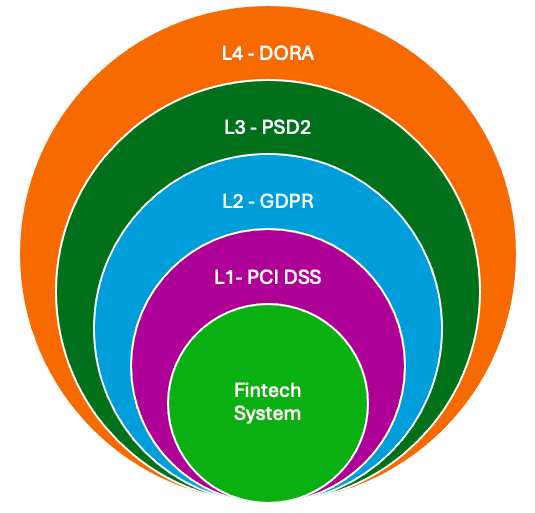

The Layered Approach of Compliance: Imagine these regulations as layers of a high-tech security system:

- Layer 1: PCI DSS protects the data itself.

- Layer 2: GDPR ensures that the data is used ethically and transparently.

- Layer 3: PSD2 opens up the market to new players and innovation while safeguarding transaction security.

- Layer 4: DORA fortifies the entire operational framework against a wide array of digital risks.

Diagram: The Compliance Layers in Fintech

The Symbiosis of Compliance Standards in Acti/on

Integrating PCI, GDPR, PSD2, and DORA isn’t just about ticking off checkboxes. It’s about creating a seamless mesh where each compliance standard complements the others. For instance, while PCI safeguards transaction data, GDPR protects the personal details associated with that data. Meanwhile, PSD2 opens the door for innovation in payment services without compromising security, supported by DORA’s overarching focus on operational resilience.

Taking Action: Implementing Compliance in Your Fintech Venture

Here’s the fun part – rolling up your sleeves and diving into compliance implementation! 🛠️

- Step 1: Assessment – Start by assessing your current security and privacy measures against the compliance requirements.

- Step 2: Planning – Develop a strategy to address any gaps. This might involve overhauling your data handling processes or upgrading your IT infrastructure.

- Step 3: Implementation – Roll out the necessary changes, whether that’s training your team on GDPR compliance or deploying new encryption technologies for PCI DSS.

- Step 4: Monitoring and Adjusting – Compliance is not a one-and-done deal. Continuous monitoring and adjustments are crucial as both technology and regulatory landscapes evolve.

Why This All Matters

In the thrilling world of fintech, staying compliant is not just about avoiding fines—it’s about winning customer trust, fostering innovation, and building a business that stands the test of time. By understanding and implementing these compliance standards, you’re not just following rules; you’re steering your ship safely through the tempestuous seas of digital finance. 🚀

Conclusion

Navigating the complex waters of fintech compliance can seem daunting, but it’s also an exciting challenge that can set your business apart. With PCI, GDPR, PSD2, and DORA as your navigational stars, you’re well on your way to creating a secure, trustworthy, and innovative financial service. So, let’s gear up, stay curious, and lead the charge in the fintech revolution! Are you ready? Because the future of fintech compliance starts with you! 🌟

FAQs

1. What is the first step in becoming compliant with these fintech regulations?

- Answer: The first step is conducting a thorough risk assessment of your current operations against the requirements of each regulation. Identify where your operations intersect with PCI, GDPR, PSD2, and DORA, and evaluate your current practices against their standards. This will highlight gaps and help you develop an actionable plan to address them.

2. How often should I review my compliance status with PCI, GDPR, PSD2, and DORA?

- Answer: Compliance is not a set-it-and-forget-it deal. Regular reviews are crucial, ideally annually or biannually, or whenever there are significant changes to your operations, the regulations, or technology that might impact your compliance posture.

3. Can a small fintech startup afford to meet all these regulatory requirements?

- Answer: Yes, although it can be challenging. Many regulatory bodies understand the constraints on smaller entities and provide scaled requirements or extended timelines. Startups should focus on the most critical compliance areas first, seek expert advice, and consider using compliance as a service platforms to manage costs and resources effectively.

4. What are the penalties for non-compliance with these standards?

- Answer: Penalties can be severe, ranging from hefty fines to operational restrictions, or even license revocations depending on the severity and nature of the compliance failure. For instance, GDPR violations can result in fines of up to 4% of annual global turnover or €20 million (whichever is greater).

5. How do GDPR and PSD2 interact when it comes to consumer data?

- Answer: GDPR and PSD2 share common goals in protecting consumer data but focus on different aspects. GDPR governs the privacy and security of personal data, while PSD2 regulates payment services and user data access by third parties. Both require stringent data protection measures, but PSD2 also emphasizes the secure sharing of financial data between banks and authorized third parties, underpinning the importance of consumer consent.

6. Is there a one-size-fits-all approach to fintech compliance?

- Answer: Not really. While the core principles of these regulations are broadly applicable, the specific implementation can vary significantly based on factors like company size, the type of financial activities involved, and geographic location. Tailoring your approach to your specific circumstances is essential.

7. How can I ensure my third-party providers comply with DORA regulations?

- Answer: You must conduct due diligence on all third-party providers to ensure they meet DORA standards. Include compliance clauses in your contracts and regularly audit their practices. Establish clear communication channels for reporting issues and ensure they participate in your incident response plans.

8. What tools can help automate compliance monitoring and reporting?

- Answer: Several compliance technology solutions can help, such as GRC (Governance, Risk Management, and Compliance) platforms, which automate many aspects of compliance monitoring, management, and reporting. Tools like these are invaluable in maintaining an ongoing compliance status across various regulations.

9. How does compliance impact international fintech operations?

- Answer: Compliance can be particularly complex for fintechs operating across multiple jurisdictions. Each region may have its own set of regulations, which might conflict or overlap. It’s crucial to have a localized compliance strategy that respects all applicable laws and regulations, potentially requiring localized teams or consultants.

10. Can good compliance be a competitive advantage in fintech? – Answer: Absolutely! Beyond meeting regulatory requirements, robust compliance can enhance your company’s reputation, build trust with customers, and provide a competitive edge by demonstrating your commitment to protecting consumer data and ensuring the integrity of your financial services.

By addressing these FAQs, fintech businesses can better understand how to strategically approach compliance, turning potential regulatory hurdles into opportunities for enhanced credibility and market differentiation. 🚀

Great information!