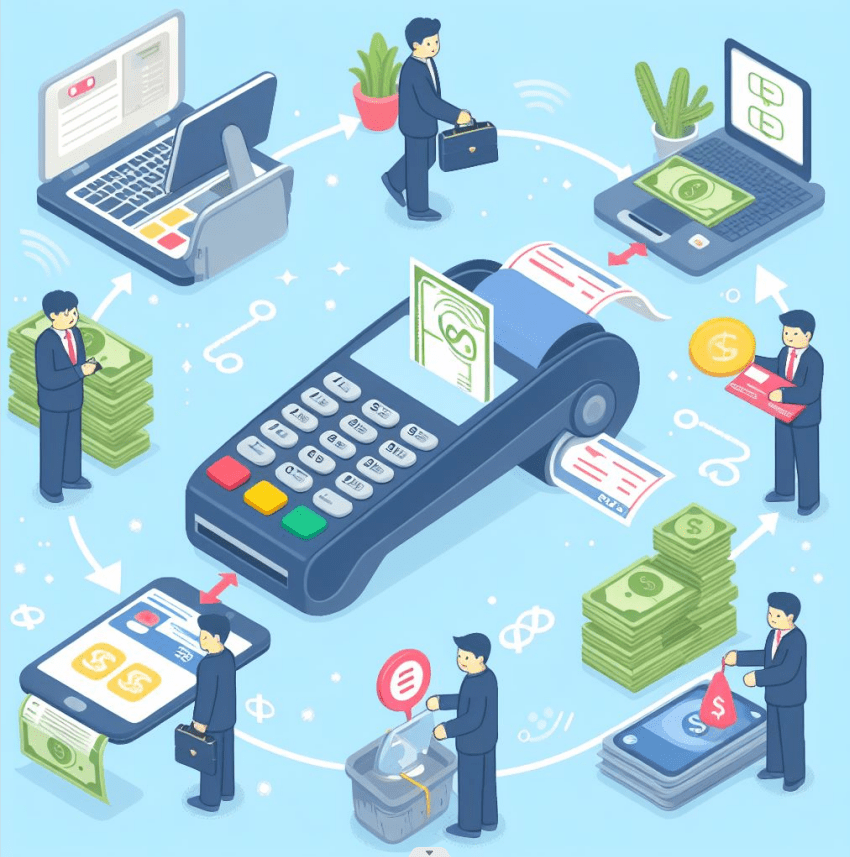

High Level Design of Payment Gateway

Designing a payment gateway involves several components and considerations to ensure secure and efficient processing of transactions. It will help you to create a robust and secure platform for processing online payments effectively.

Here’s the major actors who will be part of the flow of a payment transaction from a Point of Sale (POS) terminal to an acquirer:

- Customer: Initiates the payment by swiping, inserting, or tapping their card at the POS terminal.

- POS Terminal: Captures the payment details and sends the transaction request.

- Merchant: The business owner or retailer who operates the POS terminal.

- Acquirer: The financial institution (usually a bank) that processes the payment on behalf of the merchant.

- Payment Gateway: Connects the POS terminal to the acquirer’s network.

- Card Network: Such as Visa, Mastercard, or American Express. Routes the transaction to the issuing bank.

- Issuing Bank: The bank that issued the customer’s card. Authorizes or declines the transaction.

- Authorization Response: Sent back to the POS terminal, indicating whether the payment is approved or declined.

Below are the key components that are required at low level for this transaction to work seamlessly.

- User Interface (UI):

The UI allows merchants to interact with the payment gateway to set up accounts, view transaction history, and configure settings.

Users should be able to initiate transactions, view transaction status, and manage their account information. - API Layer

Provides APIs for integration with various platforms such as websites, mobile apps, and point-of-sale systems.

APIs handle requests for processing payments, retrieving transaction data, and managing merchant accounts.

APIs should be well-documented and support various programming languages and protocols. - Payment Processing Logic

Core logic responsible for processing payment transactions securely and efficiently.

Verifies transaction details, including payment amount, currency, and customer information.

Handles different payment methods such as credit/debit cards, digital wallets, and bank transfers. - Security Measures

Implement industry-standard security protocols like TLS encryption to secure communication between clients and the payment gateway.

Utilize tokenization to replace sensitive card data with non-sensitive tokens, reducing the risk of data breaches.

Implement fraud detection mechanisms to identify and prevent fraudulent transactions.

Compliance with PCI DSS (Payment Card Industry Data Security Standard) to ensure the secure handling of cardholder data. - Payment Processing Network Integration

Integration with payment processing networks (e.g., Visa, Mastercard, American Express) to authorize and settle transactions.

Establish connections with acquiring banks to route transactions and receive funds.

Support for multiple currencies and international transactions. - Transaction Management

Logging and tracking of transaction data for auditing, reporting, and reconciliation purposes.

Ability to handle refunds, voids, and chargebacks.

Real-time transaction monitoring and alerting for suspicious activities. - Scalability and Redundancy

Design the system to handle a high volume of transactions and scale horizontally to accommodate growth.

Implement redundancy and fail over mechanisms to ensure high availability and fault tolerance. - Reporting and Analytics

Provide merchants with reporting tools to analyze transaction data, track sales performance, and identify trends.

Generate customizable reports on transaction volume, revenue, and other metrics. - Compliance and Regulations

Stay compliant with relevant financial regulations and standards, such as PSD2 (Payment Services Directive 2) in Europe.

Maintain compliance with regional laws regarding data protection and privacy. - Customer support and Documentation

Offer customer support channels for merchants to seek assistance with technical issues and account management.

Provide comprehensive documentation, FAQs, and troubleshooting guides for developers and merchants. - Monitoring and Maintenance

Implement monitoring tools to track system performance, detect anomalies, and troubleshoot issues proactively.

Regularly update and patch software components to address security vulnerabilities and ensure system stability.