Unleashing DORA

A Game Changer for EU’s Fintech Resilience!

Introduction:

- Hey everyone! 🌟 Ever noticed how our digital world is becoming a bit of a wild west with cyber threats lurking around every corner? Well, the EU has fired a silver bullet with the Digital Operational Resilience Act (DORA) to protect our financial frontier! Let’s dive into what this means for our industry and why it’s a big deal!

What is DORA?

- Picture this: a robust shield designed specifically for the financial sector, aiming to ward off digital disruptions. That’s DORA in a nutshell! It’s part of the EU’s grand plan to ensure every financial player, big or small, can stand strong against cyber threats. 🛡️

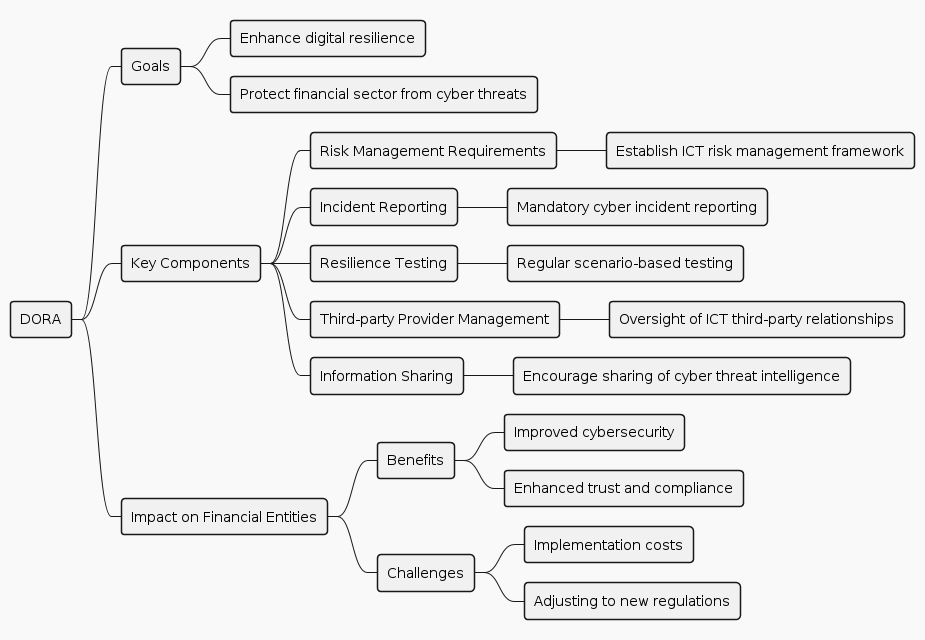

- Refer to the high level features of DORA.

Key Components of DORA:

- Risk Management Requirements:

- Imagine having an iron-clad strategy that not only defends against cyberattacks but also adapts and evolves. That’s what DORA expects from financial entities – a dynamic, bulletproof approach to risk management! 🎯

- Reporting Incidents:

- Quick! Something goes wrong; what do you do? Under DORA, you report it—fast! This isn’t just about ticking boxes; it’s about being transparent and swift to keep everyone in the loop and reduce harm. 🚨

- Digital Operational Resilience Testing:

- Get this: DORA wants institutions to regularly test their cyber mettle through rigorous stress tests and scenario analysis. It’s like a fire drill, but for cyber threats! 🔥

- Third-party Provider Management:

- Ever worry about the security of your cloud services or other tech providers? Well, DORA is setting the stage for stringent checks and balances on all third-party vendors. No more sleepless nights wondering if your data is safe. 💤

- Information Sharing:

- There’s power in unity! DORA encourages sharing intel on cyber threats, turning what could be isolated battles into a united front against cyber risks. Together, we’re unstoppable! 💪

Impact of DORA:

- For my fellow fintech aficionados, DORA isn’t just another regulation; it’s a catalyst for elevating our digital game. The enhanced resilience it brings can make the EU a safer place for innovators and customers alike. 🌍

Challenges and Considerations:

- But let’s keep it real; change isn’t easy. Adapting to DORA will be a hefty challenge, especially for smaller outfits that might struggle with the resources needed. It’s about finding a balance and moving forward together. ⚖️

Conclusion:

- So, what’s the bottom line? DORA is here, and it’s fabulous! It’s our ticket to a safer, more resilient financial ecosystem. Let’s gear up, embrace the change, and lead the charge towards a secure digital future! 🚀🚀